Easy to Overview of Health Insurance Plans

Introduction for Detailed Overview of Health Insurance Plans:-

Health insurance covers a portion of policyholders’ healthcare and hospital expenditures to assist them afford outrageous medical bills. Each country has a separate public healthcare system, therefore coverage differs.Insurance Business explains health insurance policies in the US, Canada, UK, and Australia in this client education series. We will also discuss citizen policies and their benefits.

Insurance agents and brokers should share this material with clients to explain this vital coverage.

The US search for inexpensive health plans

The Affordable Care Act (ACA) was passed in 2010 to lower family healthcare expenses and expand health insurance coverage. Patients without insurance due to financial hardship or pre-existing diseases can now get inexpensive coverage through their state’s health insurance marketplace under the ACA.

How does US Overview of health insurance Plans work?

These health insurance marketplaces offer a variety of coverages for different healthcare requirements.

HealthCare.gov states, “Some types of plans restrict your provider choices or encourage you to get care from the plan’s network of doctors, hospitals, pharmacies, and other medical service providers.” “Others pay more for providers outside the plan’s network.”

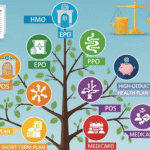

These Overview of health insurance Plans marketplaces provide these plans:

Health Maintenance Organization

This health insurance plan usually covers only HMO-affiliated doctors. Policies rarely cover out-of-network care barring in emergencies. For coverage, plans may demand policyholders to live or work in their service region. Integrated HMOs emphasize preventive and wellness.

Exclusive Provider Organization

Unless in emergencies, this managed care plan covers only doctors, specialists, and hospitals in its network. This means that policyholders who choose out-of-network providers must pay for treatment in full.

Service Point

If they use network doctors, hospitals, and other healthcare providers, policyholders pay less in this plan. The insured must acquire a recommendation from their primary care doctor to see a specialist under POS coverage.

Preferred Provider Organization

This health plan offers lower healthcare costs for subscribers who use network providers. They can see doctors, hospitals, and providers outside the network without a referral for a fee.

HealthCare.gov said that US health insurance plans are divided into four groups by insurer-policyholder cost. These plans, called “metal tiers,” are:

• Bronze: 60% health insurer, 40% policyholder

• Silver: 70% health insurer, 30% policyholder

• Gold: 80% health insurer, 20% policyholder

• Platinum: 90% health insurer, 10% policyholder

What does US Overview of health insurance Plans cover?

In the healthcare system, the ACA standardized insurance plan benefits. Before this, benefits varied greatly by insurance company and policy. Current US health insurance policies must include these 10 “essential health benefits.”

1. Outpatient care

2. Emergency services

3. Hospitalization

4. Laboratory services

5. Mental health, substance abuse, and behavioral health services

6. Oral and visual care for children

7. Maternity, newborn, and pregnancy care

8. Prescription drugs

9. Prevention, wellness, and chronic disease management

10. Services and devices for rehabilitation

Benefits must include birth control and breastfeeding. Adult dental and eye care are optional add-ons, as are medical management programs.

What does US Overview of health insurance cost?

According to Kaiser Family Foundation marketplace benchmark premiums, US health insurance premiums average $456 per person each month. This can be costly for some American families.

This may not affect many employed people because their employers cover four-fifths of their health insurance expenditures. However, those without company-sponsored care must find their own health plan and pay full premiums.

HealthCare.gov states that ACA insurers can only consider five factors when setting premiums. These are:

• Age: Premiums for older Americans might be up to three times more than for younger Americans.

• Health insurance rates are influenced by location, competition, state and municipal restrictions, and cost of living.

• Tobacco use: Insurers may charge smokers up to 50% more than non-smokers.

Individual vs. family enrollment: Insurance carriers may charge more for plans that cover spouses and dependents.

• Plan category: Metal tiers (Bronze, Silver, Gold, and Platinum) affect premium costs.

Medical history and gender cannot be used to calculate insurance premiums, although states can limit their impact.

Insurance marketplace: Everything your clients need to know Insurance companies can’t charge women and men different pricing for the same plan, says HealthCare.gov. “They can’t consider your current health or medical history. All health plans must cover pre-existing diseases from day one.”

American health insurance carriers offer basic policies to individuals and corporations, as well as Medicaid, Medicare, long-term care, dental, and vision benefits. The top 10 health insurers control about two-thirds of the market.

Canada has world-class healthcare.

Canada has one of the world’s top healthcare systems, offering free emergency care and regular doctor visits to all citizens and permanent residents. Canadians must pay for services that Medicare does not cover.

Canadian healthcare: how does it work?

Canadians receive public healthcare under the Canada Health Act. Each provincial and territorial health insurance plan must meet the five pillars of the CHA to earn full federal cash contributions:

1. Universal

2. Management by the public

3. Comprehensive coverage terms

4. Transferable across provinces and territories

5. Accessible (No user costs)

“Health care is funded and administered primarily by the country’s 13 provinces and territories,” according to the Commonwealth Fund, a private non-profit that supports independent health care research and gives grants to improve the health system. Each has its own insurance plan and receives per-capita federal cash assistance.”

Despite differences in benefits and delivery, all Canadians and permanent residents receive “medically necessary hospital and physician services free at the point of use.”

Medicare doesn’t cover everything. This includes:

• Dental and eye care

• Prescription medications for outpatients

• Rehabilitation services

• Canadians must pay for private hospital rooms with their own money.

According to the Canadian Life and Health Insurance Association, approximately 70% of Canadians have taken out supplemental private health coverage, even though it is not required. Over 90% were obtained through group plans.

The Canadian universal healthcare system covers what?

Medicare covers numerous healthcare fundamentals in Canada:

• Hospital and doctor appointments

• Exams and diagnoses

• Eye exams for Canadians under 18 or over 65.

• Medically required dental procedures

• Standard hospital accommodations (care, food, and prescriptions)

• Surgery and treatment

Exclusions vary by province and territory due to health coverage laws. Private health insurance may be needed for the following items and services, depending on location.

• EMT and ambulance services

• Dental care

• Massage therapy

• Medical equipment (wheelchairs, crutches, leg braces)

• Prescription drugs for outpatients

• Physical treatment

– Prescription eyeglasses

• Hospital room stays, private

• Psychological services

What does Canadian private health insurance cost?

Private health insurance costs $756 per year, or $63 per month, according to the Canadian Institute for Health Information (CIHI). The average Canadian spent $902 on out-of-pocket health care, or $75 each month, according to the institute.

These data were taken before COVID-19 jolted Canada’s and the world’s healthcare systems, so they may be higher now. Furthermore, the values provided are estimations, so contact health insurance carriers directly for an accurate amount.About 130 private health insurance carriers serve 27 million Canadians. These firms offer top supplemental health insurance.

Residence-based system in UK

The National Health Service (NHS) provides free healthcare to all UK residents.

NHS care is based on residency, not insurance. The NHS provides free healthcare to all UK residents and workers, even those on temporary work visas.

NHS services range from primary care to specialist therapies. This includes:

• GP or nurse consultations

• Sexual health and contraception services

• Maternity services

• Hospital treatment for accidents and emergencies (A&E)

• Clinic treatment for minor injuries

• GP referral for expert or consultant treatment.

However, like other public healthcare systems, the NHS has substantial wait times due to its high usage. UK individuals can choose private health insurance to access specialists faster and use superior facilities.

UK private health insurance—how does it work?

UK private health policies cover acute care. This implies most health plans cover short-term, treatable medical conditions rather than chronic ailments, which patients usually live with forever.

Brits have various private health insurance options. This includes:

• Individual health insurance: Offers private medical treatment for non-employer-insured individuals.

• Family health insurance: Provides private medical treatment for policyholders and their loved ones.

• Child health insurance: Offers private medical care for children under 18, with flexible age requirements for full-time students.

• Company health insurance: Provides private medical care to employees.

• Health insurance for over 50s: Provides private medical services to individuals over 50.

What are the UK private health insurance pros and cons?

Private health insurance benefits include:

• Easier access to health care at the time of need

• Control over treatment location, timing, and provider.

• Private room access instead than limited to a bustling ward.

• Access specialty medications and treatments not available on the NHS.

Private health insurance also has drawbacks:

• High coverage costs

• Excludes certain treatments and services.

• Typically includes surplus

The NHS provides free access to most covered therapies.

• Private hospitals frequently lack an A&E section.

What does UK private health insurance cost?

NimbleFins, a London-based personal finance website, discovered that private health insurance in the UK costs £85 per month or £1,200 annually.

Like other places, premium prices depend on several factors. Include the policyholder’s:

• Age• Residence

• Smoking status

• Health issues in the past

• History of claims

Australia: Premium rebates, tax incentives Australians may wait long for non-life-threatening treatments despite having one of the strongest public healthcare systems in the world. Like in Canada, they may have to pay for services Medicare does not cover.

Tax incentives and premium rebates from the Australian government encourage private health insurance for this reason.

How does Australian private health insurance work?

Private health insurance in Australia covers medical expenses not covered by public healthcare. It can also include private hospital treatment or public hospital treatment as a private patient. Australians can only buy health insurance from registered companies.

Two basic types of private health insurance exist:

• Hospital cover: Covers treatment costs in public or private hospitals.

• Extras cover, often known as general treatment cover, covers medical services not covered by Medicare.

Most states and territories offer ambulance coverage for emergency transport and medical care. Queensland and Tasmania provide automatic coverage for residents.

What are the benefits of Australian private health insurance?

This coverage has four primary benefits, according to the Department of Health’s website. These are:

• Extra health coverage and options: Private health insurance allows policyholders to receive treatment in private hospitals with lower wait periods for non-urgent procedures. They can also pick their doctor.

• fee incentives: Policyholders can avoid the Medicare Levy Surcharge (MLS), a fee on Australians without private hospital coverage and earning a specific income. This charge encourages private insurance to relieve public health system strain.

• Premium rebates: The government provides a “income-tested” refund to most Australians with private health coverage to cover premium costs.

• Avoid LHC loading: Australians who purchased private hospital cover before July 1, 2000, and maintained coverage are exempt from paying an extra amount called “lifetime health cover loading.” Those who did not may face higher premiums for the next 10 years.

What does Australian private health insurance cost?

Australian private health insurance premiums depend on numerous factors. These include the policy type, tier, number of persons covered, and policyholder age, income, and residency.

The four hospital coverage tiers—Gold, Silver, Bronze, and Basic—cover a prescribed set of treatments. Gold insurance have the highest premiums because they cover all 38 government-listed therapies.

The comparison website Finder estimated that a gold hospital policy costs $228 per month. Basic, bronze, and silver insurance cost $99, $120, and $180 per month. Extra coverage averages $68 per insurance per month.

The Private Health Insurance Ombudsman (PHIO) publishes a State of the Health Funds report annually to compare the performance and service delivery of all health insurers in the country. The research also ranks Australia’s top private health insurers by important indicators.

Are you considering private health insurance?